Home /

Expert Answers /

Accounting /

account-titles-and-explanation-debit-credit-supplies-expense-35-supplies-4-depreciation-expen-pa126

(Solved): Account Titles and Explanation Debit Credit Supplies Expense 35 Supplies 4 Depreciation Expen ...

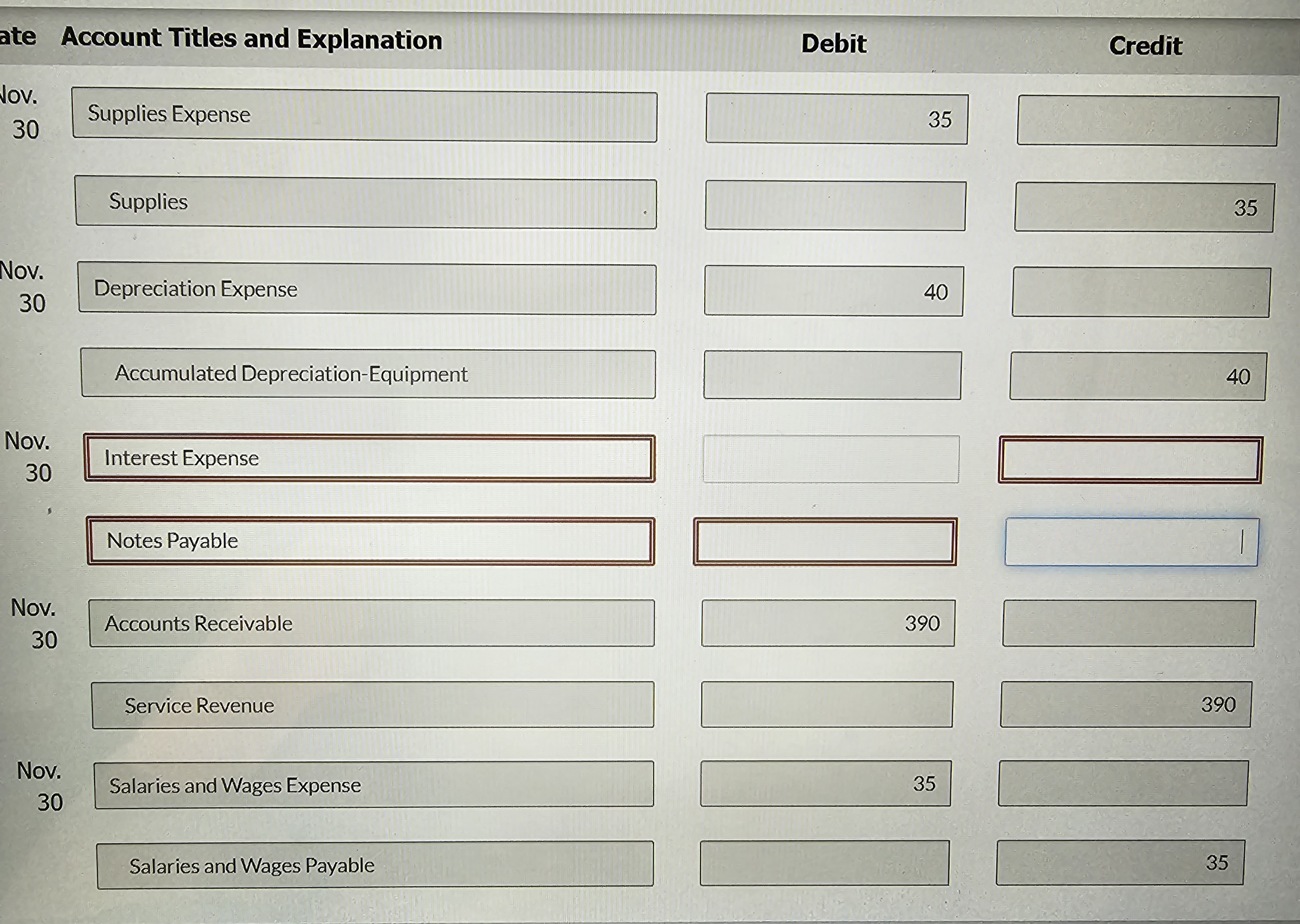

Account Titles and Explanation Debit Credit Supplies Expense 35 Supplies Depreciation Expense 40 Accumulated Depreciation-Equipment Nov. Interest Expense Notes Payable Nov. Accounts Receivable Service Revenue Nov. Salaries and Wages Expense 35 Salaries and Wages Payable 35

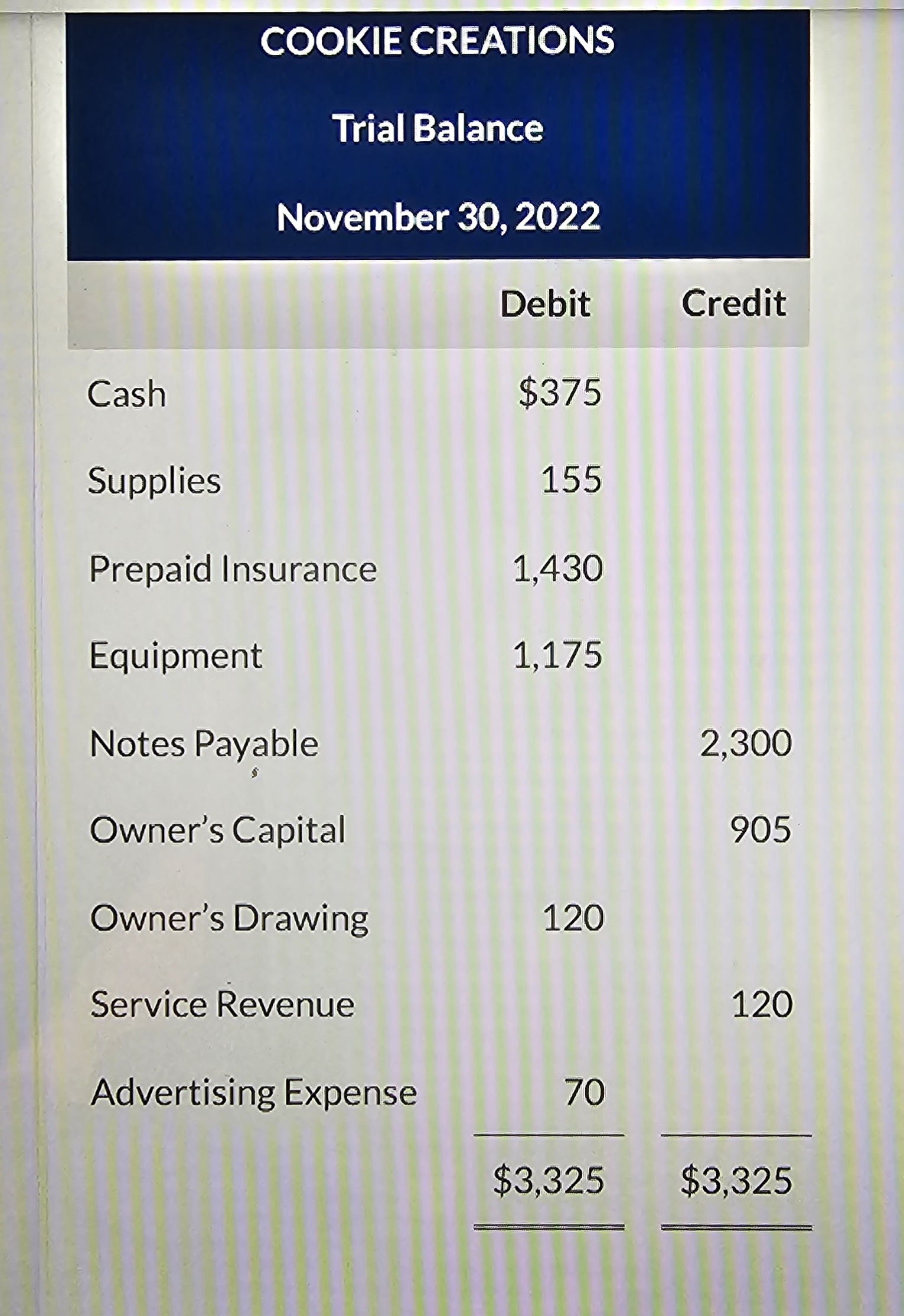

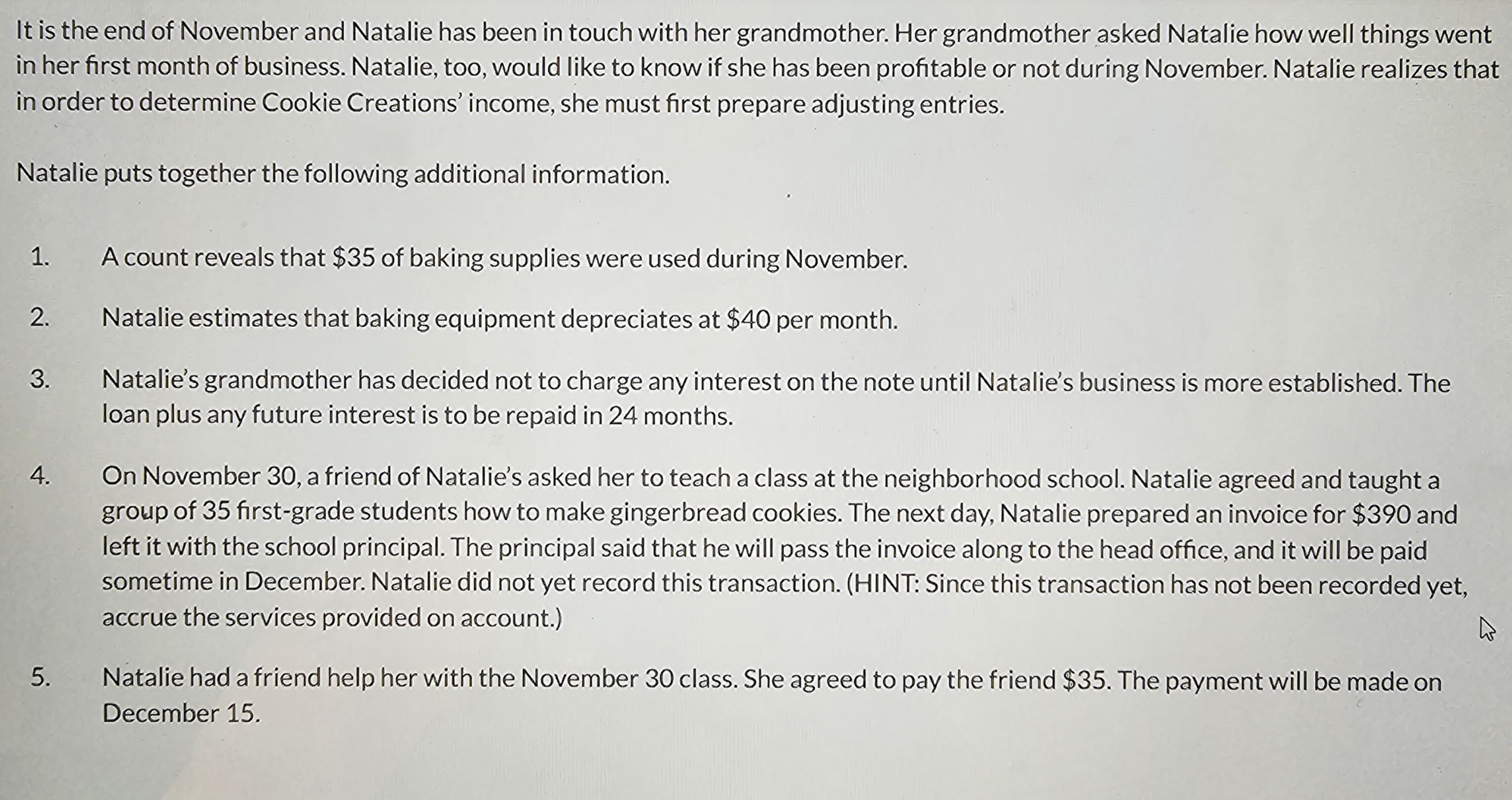

It is the end of November and Natalie has been in touch with her grandmother. Her grandmother asked Natalie how well things went in her first month of business. Natalie, too, would like to know if she has been profitable or not during November. Natalie realizes that in order to determine Cookie Creations' income, she must first prepare adjusting entries. Natalie puts together the following additional information. 1. A count reveals that of baking supplies were used during November. 2. Natalie estimates that baking equipment depreciates at per month. 3. Natalie's grandmother has decided not to charge any interest on the note until Natalie's business is more established. The loan plus any future interest is to be repaid in 24 months. 4. On November 30, a friend of Natalie's asked her to teach a class at the neighborhood school. Natalie agreed and taught a group of 35 first-grade students how to make gingerbread cookies. The next day, Natalie prepared an invoice for and left it with the school principal. The principal said that he will pass the invoice along to the head office, and it will be paid sometime in December. Natalie did not yet record this transaction. (HINT: Since this transaction has not been recorded yet, accrue the services provided on account.) 5. Natalie had a friend help her with the November 30 class. She agreed to pay the friend . The payment will be made on December 15.