Home /

Expert Answers /

Advanced Math /

a-put-option-in-finance-allows-you-to-sell-a-share-of-stock-at-a-given-price-in-the-future-there-a-pa362

(Solved): A put option in finance allows you to sell a share of stock at a given price in the future. There a ...

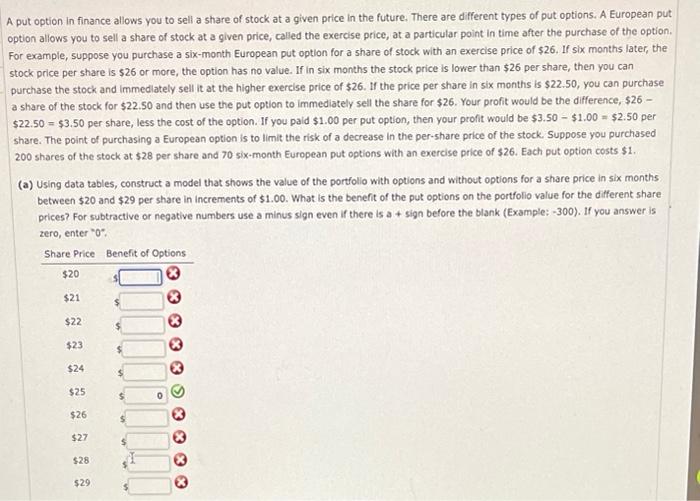

A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put options. A European put option allows you to sell a share of stock at a given price, called the exercise price, at a particular point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a share of stock with an exercise price of \( \$ 26 \), If slix months later, the stock price per share is \( \$ 26 \) or more, the option has no value. If in six months the stock price is lower than \( \$ 26 \) per share, then you can purchase the stock and immedlately sell it at the higher exercise price of \( \$ 26 \). If the price per share in six months is \( \$ 22.50 \), you can purchase a share of the stock for \( \$ 22.50 \) and then use the put option to immediately sell the share for \( \$ 26 \). Your profit would be the difference, \( \$ 26 \) \( \$ 22.50=\$ 3.50 \) per share, less the cost of the option. If you paid \( \$ 1.00 \) per put option, then your profit would be \( \$ 3.50-\$ 1.00=\$ 2.50 \) per share. The point of purchasing a European option is to limit the risk of a decrease in the per-share price of the stock. Suppose you purchased 200 shares of the stock at \( \$ 28 \) per share and 70 six-month European put options with an exercise price of \( \$ 26 \). Each put option costs \( \$ 1 \). (a) Using data tables, construct a model that shows the value of the portfollo with options and without options for a share price in six months between \( \$ 20 \) and \( \$ 29 \) per share in increments of \( \$ 1.00 \). What is the benefit of the put options on the portfolio value for the different share prices? For subtractive or negative numbers use a minus sign even if there is a \( + \) sign before the blank (Example: \( -300 \) ). If you answer is zero, enter \( { }^{\circ} 0^{\circ} \).