Home /

Expert Answers /

Accounting /

a-prepare-an-unadjusted-trial-balance-at-may-31-2023-hint-where-do-you-get-the-infor-pa584

(Solved): a) Prepare an unadjusted trial balance at May 31,2023. HINT: Where do you get the infor ...

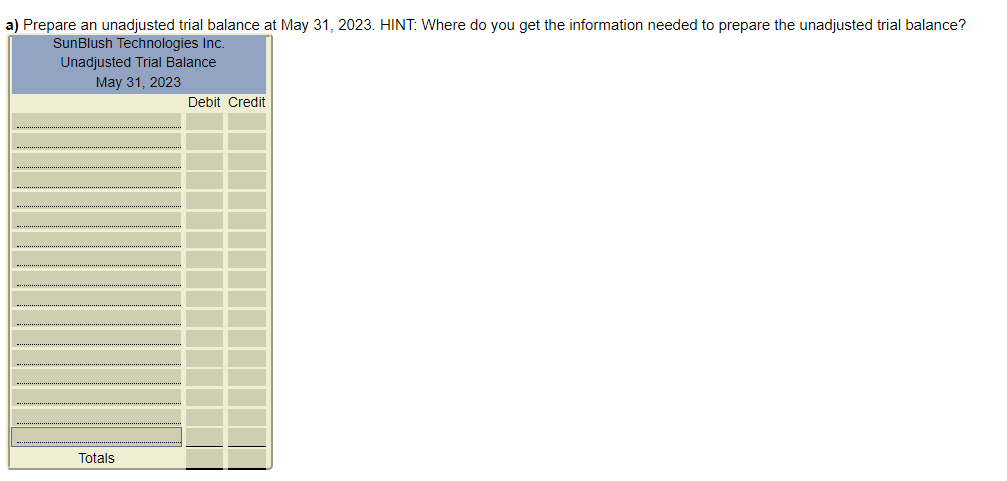

a) Prepare an unadjusted trial balance at May 31,2023. HINT: Where do you get the information needed to prepare the unadjusted trial balance?

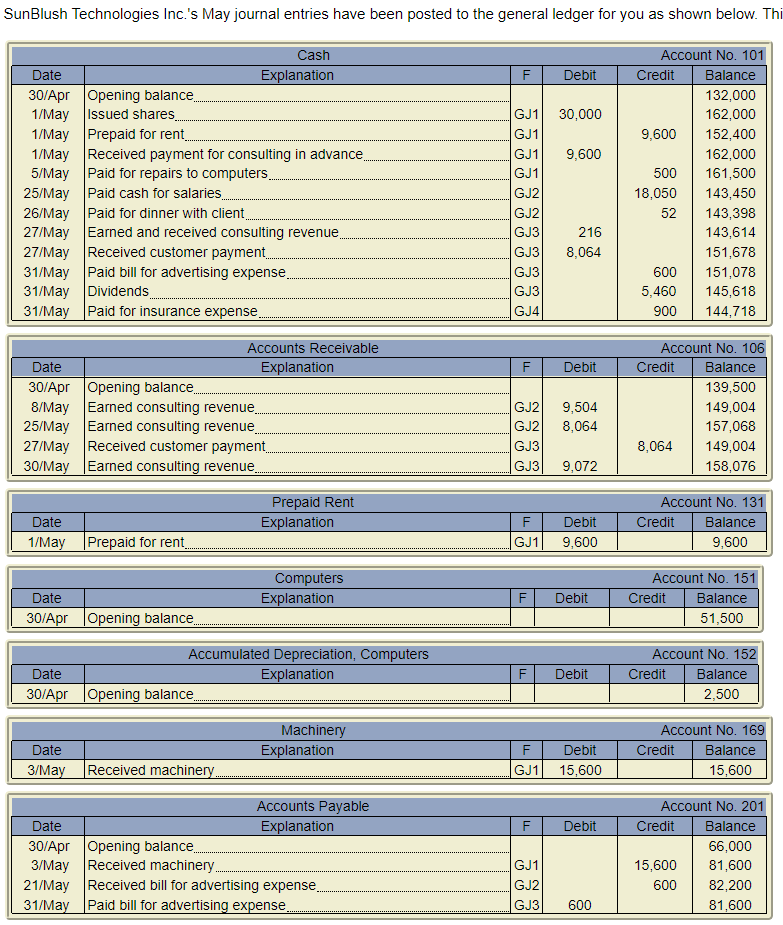

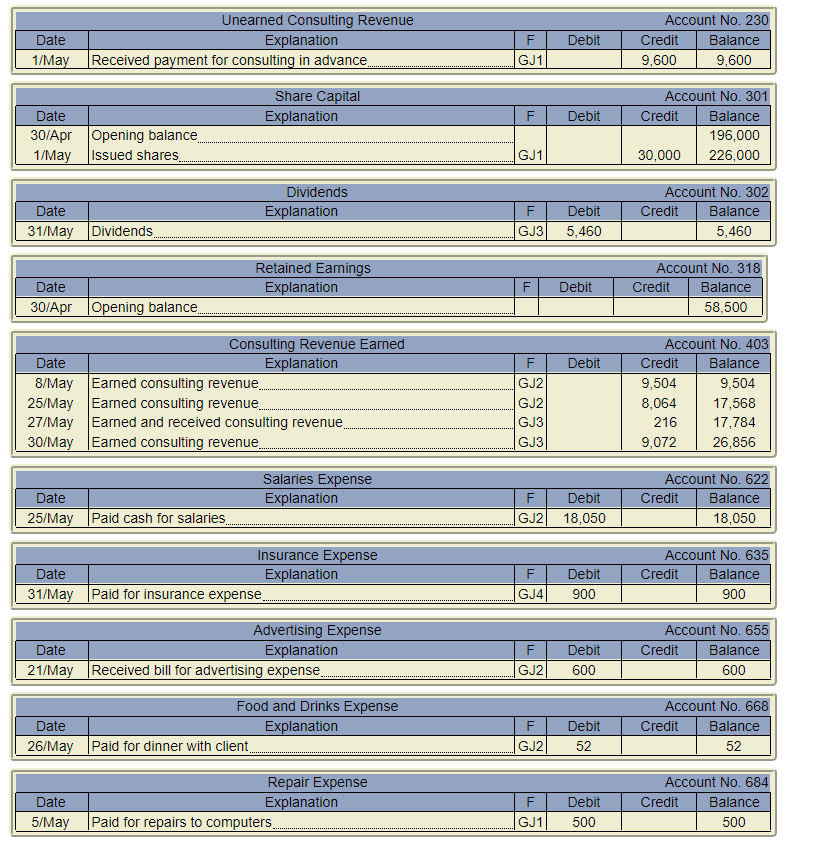

unBlush Technologies Inc.'s May journal entries have been posted to the general ledger for you as shown below.

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Unearned Consulting Revenue } & \multicolumn{2}{|c|}{ Account No. 230} \\ \hline Date & Explanation & & Debit & Credit & Balance \\ \hline 1/May & Received payment for consulting in advance & GJ1 & & 9,600 & 9,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Share Capital } & \multicolumn{2}{|c|}{ Account No. 301} \\ \hline Date & Explanation & & Debit & Credit & Balance \\ \hline & Opening balance. & & & & 196,000 \\ \hline 1/May & Issued shares... & GJ1 & & 30,000 & 226,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Dividends } & \multicolumn{2}{|c|}{ Account No. 302} \\ \hline Date & Explanation & & Debit & Credit & Balance \\ \hline 31/May & Dividends. & GJ3 & 5,460 & & 5,460 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Retained Earnings } & Account No. 318 \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 30/Apr & Opening balance & & & 58,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Consulting Revenue Earned } & \multicolumn{2}{|c|}{ Account No. 403} \\ \hline Date & Explanation & & Debit & Credit & Balance \\ \hline 8/May & Earned consulting revenue... & GJ2 & & 9,504 & 9,504 \\ \hline 25/May & Earned consulting revenue. & GJ 2 & & 8,064 & 17,568 \\ \hline 27/May & Earned and received consulting revenue & GJ3 & & 216 & 17,784 \\ \hline 30/May & Earned consulting revenue..... & GJ3 & & 9,072 & 26,856 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{9}{|c|}{ Salaries Expense } & \multicolumn{5}{c|}{ Account No. 622 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 25/May & Paid cash for salaries..............................................................................JJ2 & 18,050 & & 18,050 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Advertising Expense } & \multicolumn{2}{|c|}{ Account No. 655} \\ \hline Date & Explanation & & Debit & Credit & Balance \\ \hline 21/May & Received bill for advertising expense. & GJ2 & 600 & & 600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Food and Drinks Expense } & \multicolumn{5}{c|}{ Account No. 668} \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 26/May & Paid for dinner with client & 52 & & 52 \\ \hline \end{tabular}