Home /

Expert Answers /

Statistics and Probability /

a-develop-an-estimated-linear-regression-equation-using-trade-price-and-speed-of-execution-to-predi-pa495

(Solved): (a)Develop an estimated linear regression equation using trade price and speed of execution to predi ...

| (a) | Develop an estimated linear regression equation using trade price and speed of execution to predict overall satisfaction with the broker. | ||||||||

| Let x1 represent satisfaction with Trade Price. | |||||||||

| Let x2 represent satisfaction with speed of execution. | |||||||||

| If required, round your answer to four decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300) | |||||||||

| = + x1 + x2 | |||||||||

| What is the coefficient of determination? | |||||||||

| If required, round your answer to four decimal places. | |||||||||

| Interpret the coefficient of determination. If required, round your answer to one decimal places. | |||||||||

| The regression model explains approximately % of the variation in the values of overall satisfaction in the sample. | |||||||||

| (b) | Use the t test to determine the significance of each independent variable. What are your conclusions at the 0.05 level of significance? | ||||||||

| We - Select your answer -cancannotItem 6 conclude that ?1 = 0. That is, there - Select your answer -isis notItem 7 a relationship between satisfaction with trade price and overall satisfaction with the electronic trade. | |||||||||

| We - Select your answer -cancannotItem 8 conclude that ?2 = 0. That is, there - Select your answer -isis notItem 9 a relationship between satisfaction with speed of execution and overall satisfaction with the electronic made. | |||||||||

| (c) | Interpret the estimated parameters. Are the relationships indicated by these estimates what you would expect? | ||||||||

| |||||||||

| - Select your answer -Option (i)Option (ii)Option (iii)Option (iv)Item 10 | |||||||||

| (d) | Finger Lakes Investments has developed a new electronic trading system and would like to predict overall customer satisfaction assuming they can provide satisfactory service levels (2) for both trade price and speed of execution. Use the estimated linear regression equation developed in part (a) to predict overall satisfaction level for Finger Lakes Investments if they can achieve these performance levels. | ||||||||

| If required, round your answer to one decimal place. Do not round intermediate calculations. | |||||||||

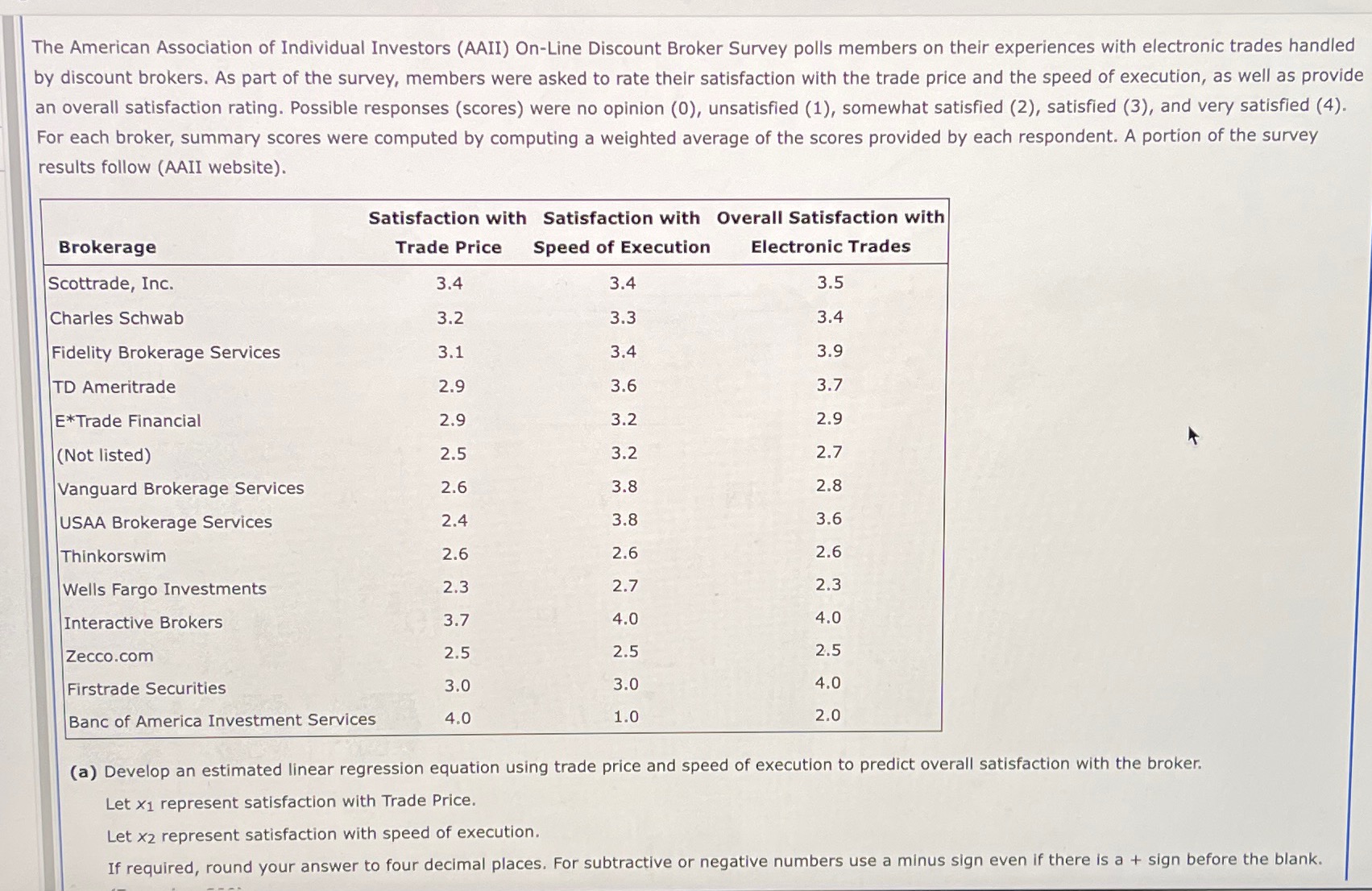

The American Association of Individual Investors (AAII) On-Line Discount Broker Survey polls members on their experiences with electronic trades handled by discount brokers. As part of the survey, members were asked to rate their satisfaction with the trade price and the speed of execution, as well as provide an overall satisfaction rating. Possible responses (scores) were no opinion (0), unsatisfied (1), somewhat satisfied (2), satisfied (3), and very satisfied (4). For each broker, summary scores were computed by computing a weighted average of the scores provided by each respondent. A portion of the survey results follow (AAII website). (a) Develop an estimated linear regression equation using trade price and speed of execution to predict overall satisfaction with the broker. Let represent satisfaction with Trade Price. Let represent satisfaction with speed of execution. If required, round your answer to four decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank.