Home /

Expert Answers /

Electrical Engineering /

a-calculate-the-irr-for-each-of-the-three-cash-flow-diagrams-that-follow-use-eoy-zero-for-i-an-pa722

(Solved): a. Calculate the IRR for each of the three cash-flow diagrams that follow. Use EOY zero for (i) an ...

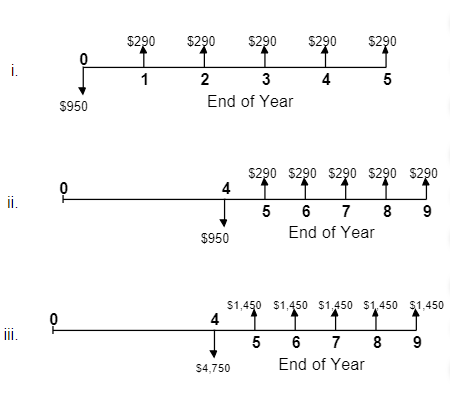

a. Calculate the IRR for each of the three cash-flow diagrams that follow. Use EOY zero for (i) and EOY four for (ii) and (iii) as the reference points in time. What can you conclude about "reference year shift" and "proportionality" issues of the IRR method? b. Calculate the PW at MARR = 12% per year at EOY zero for (i) and (ii) and EOY four for (ii) and (iii). How do the IRR and PW methods compare? ? Click the icon to view the cash-flow diagrams. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. C a. Calculate the IRR for each of the three cash-flow diagrams. (Round to one decimal place.) IRR for (i) = 16 % IRR for (ii) = 16% IRR for (iii) = 16% One can conclude that there are no special "reference year shift" and "proportionality" issues of the IRR method. b. Calculate the PW at MARR = 12% per year. (Round to the nearest cent.) PW(12%) = $ at EOY 0 PW (12%) = $ at EOY 0 PW (12%) = $ at EOY 4 PW (12%) = $ at EOY 4 How do the / methods compare? Choose the correct answer below. O A. If PW(i= MARR) 20 and IRR MARR, the project is economically justified. O C. If PW(i= MARR) < 0 and IRR > MARR, the project is economically justified. O D. If PW(i= MARR) < 0 and IRR