Home /

Expert Answers /

Accounting /

a-calculate-the-current-ratio-for-wilson-trucking-b-assuming-spalding-a-competitor-has-a-curr-pa753

(Solved): (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a curr ...

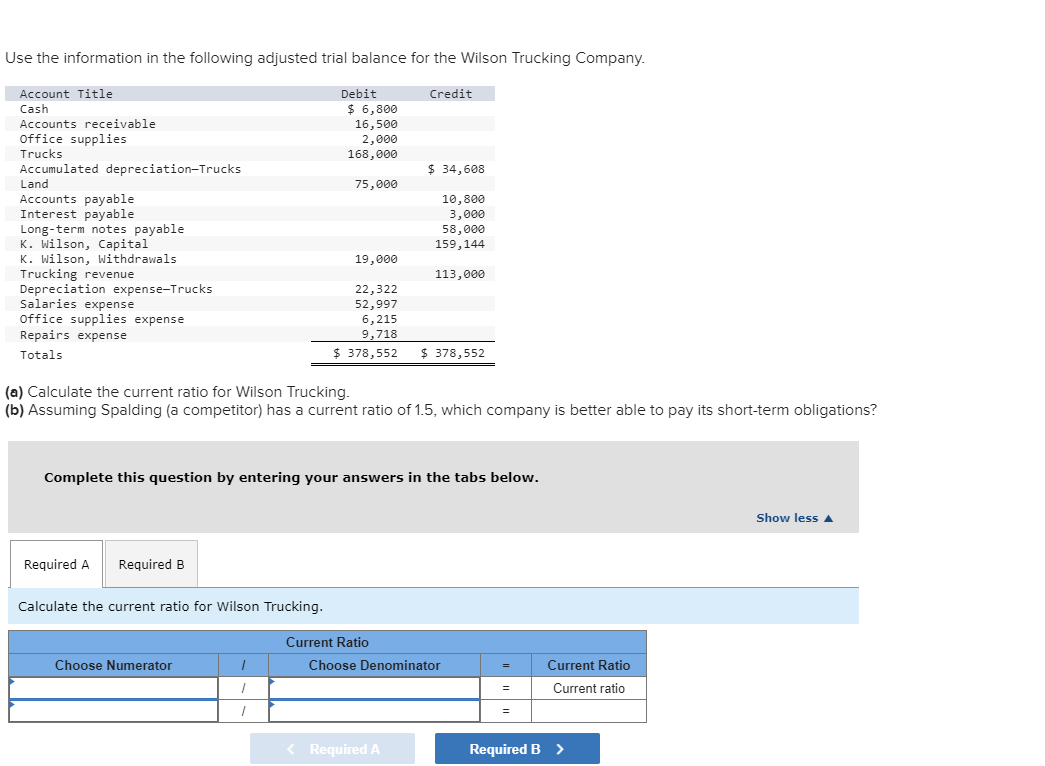

Use the information in the following adjusted trial balance for the Wilson Trucking Company. Account Title Cash Accounts receivable office supplies Trucks Accumulated depreciation-Trucks Land Accounts payable Interest payable Long-term notes payable K. Wilson, Capital K. Wilson, Withdrawals Trucking revenue Depreciation expense-Trucks Salaries expense office supplies expense Repairs expense Totals Required A Required B Calculate the current ratio for Wilson Trucking. Debit $ 6,800 16,500 2,000 168,000 75,000 (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term obligations? Choose Numerator 19,000 Complete this question by entering your answers in the tabs below. 1 1 1 Credit 22,322 52,997 6,215 9,718 $ 378,552 $ 378,552 $ 34,608 10,800 3,000 58,000 159,144 113,000 Current Ratio < Required A Choose Denominator = = = Current Ratio Current ratio Required B > Show less A

Complete this question by entering your answers in the tabs below. Required A Required B Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term obligations? Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term obligations? < Required A Show less Required B >

Expert Answer

1. Current Ratio - Current Assets = $6,800 + $16,500