Home /

Expert Answers /

Accounting /

7-from-the-french-instrument-corporation-second-quarter-report-ended-2023-do-a-vertical-analysis-f-pa704

(Solved): 7. From the French Instrument Corporation second-quarter report ended 2023, do a vertical analysis f ...

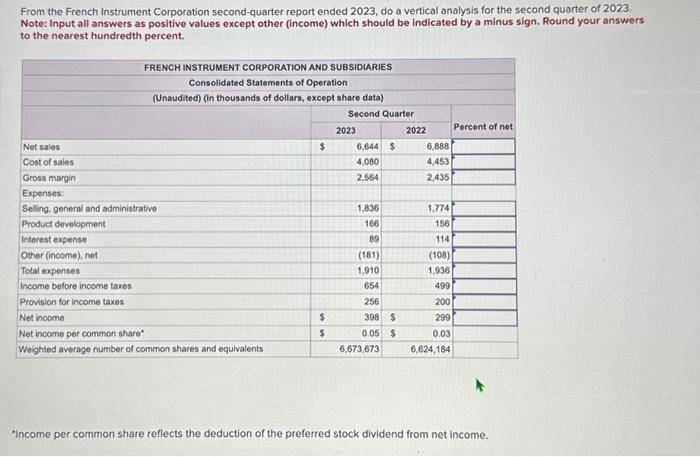

7. From the French Instrument Corporation second-quarter report ended 2023, do a vertical analysis for the second quarter of 2023. Note: Input all answers as positive values except other (income) which should be indicated by a minus sign. Round your answers to the nearest hundredth percent. Net sales Cost of sales Gross margin FRENCH INSTRUMENT CORPORATION AND SUBSIDIARIES Consolidated Statements of Operation (Unaudited) (In thousands of dollars, except share data) Expenses: Selling, general and administrative Product development Interest expense Other (income), net Total expenses Income before income taxes Provision for income taxes Net income Net income per common share* Weighted average number of common shares and equivalents $ $ $ Second Quarter 2023 6,644 $ 4,080 2,564 1,836 166 89 (181) 1,910 654 256 398 $ 0.05 $ 6,673,673 2022 6,888 4,453 2,435 1,774 156 114 (108) 1,936 499 200 299 0.03 6,624,184 Percent of net *Income per common share reflects the deduction of the preferred stock dividend from net income.

From the French instrument Corporation second-quarter report ended 2023, do a vertical anolysis for the second quarter of 2023 Note: Input all answers as positive values except other (income) which should be indicated by a minus sign. Round your answers to the nearest hundredth percent. "Income per common share reflects the deduction of the preferred stock dividend from net income.