Home /

Expert Answers /

Finance /

5-profitability-ratios-profitability-ratios-help-in-the-analysis-of-the-combined-impact-of-liquid-pa129

(Solved): 5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquid ...

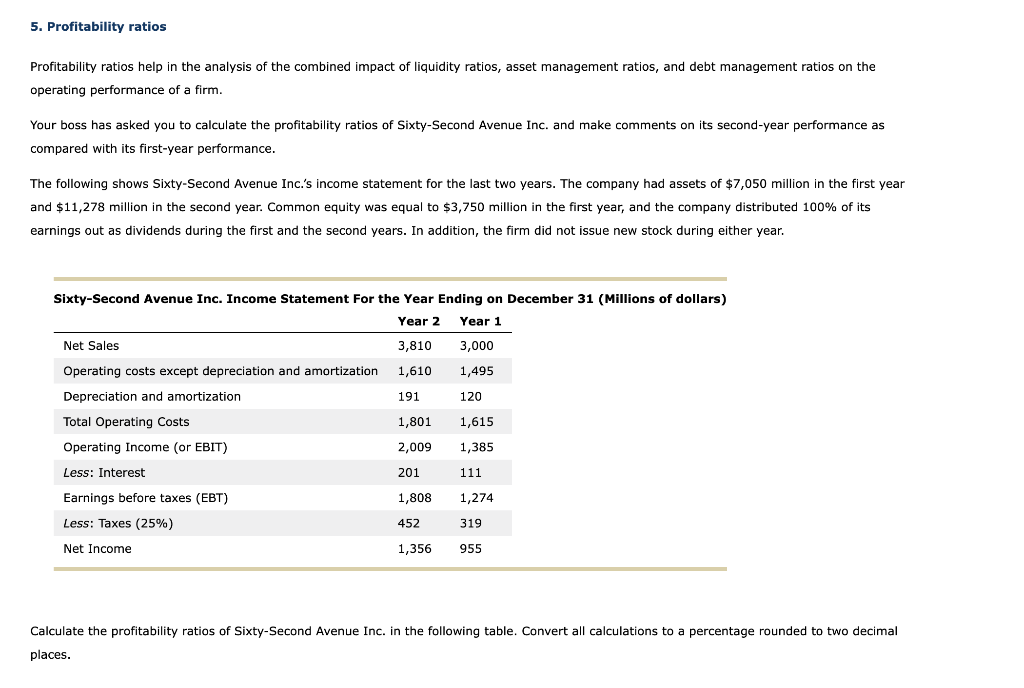

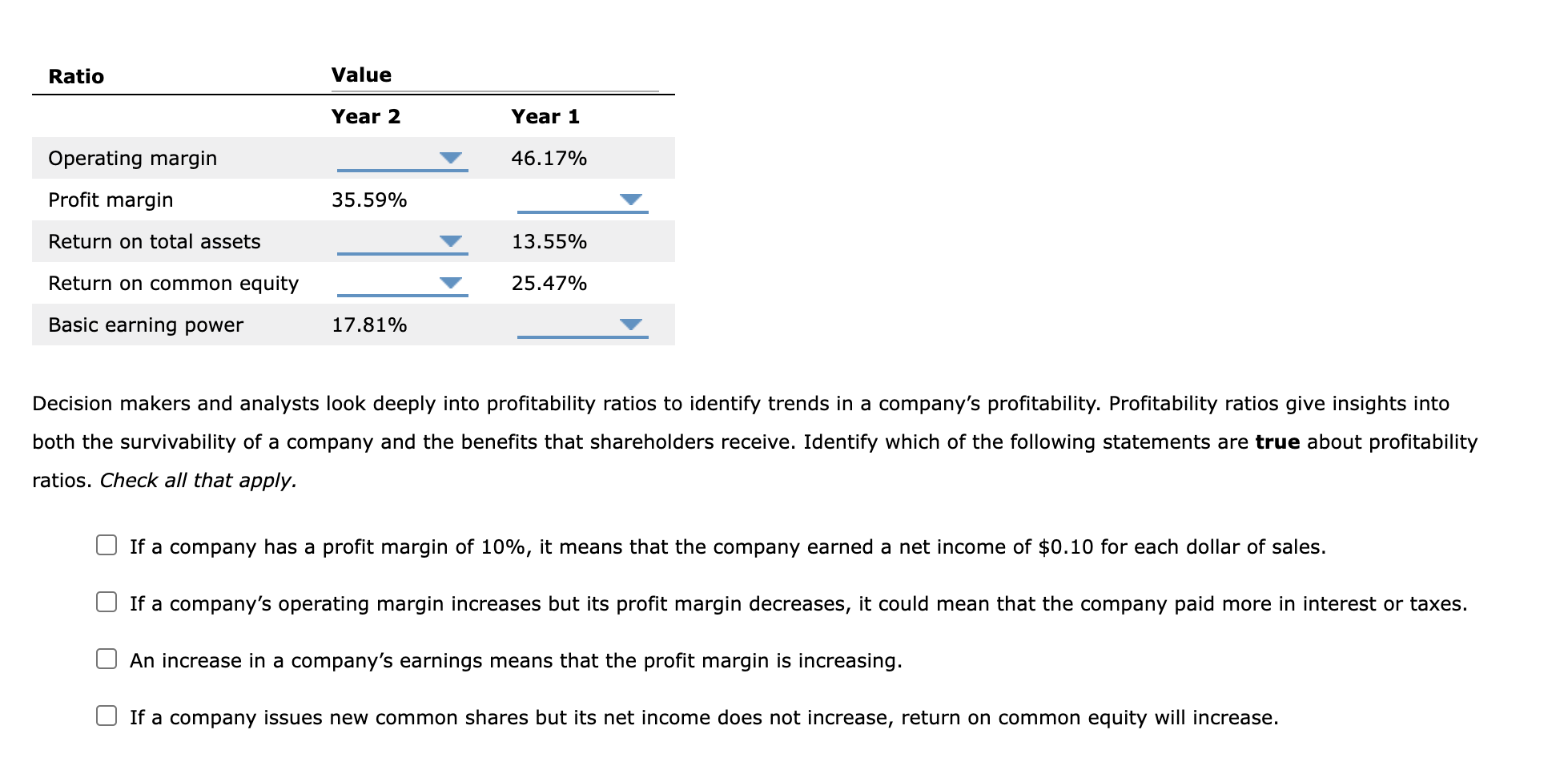

5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Sixty-Second Avenue Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Sixty-Second Avenue Inc.'s income statement for the last two years. The company had assets of \( \$ 7,050 \) million in the first year and \( \$ 11,278 \) million in the second year. Common equity was equal to \( \$ 3,750 \) million in the first year, and the company distributed 100\% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Sixty-Second Avenue Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Calculate the profitability ratios of Sixty-Second Avenue Inc. in the following table. Convert all calculations to a percentage rounded to two decimal places.

Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratios give insights into ratios. Check all that apply. If a company has a profit margin of \( 10 \% \), it means that the company earned a net income of \( \$ 0.10 \) for each dollar of sales. If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. An increase in a company's earnings means that the profit margin is increasing. If a company issues new common shares but its net income does not increase, return on common equity increase.

Expert Answer

year 2 year 1 EBIT 2009 1385 NET INCOME 1356 955 NET SALES 3810 3000 TOTAL ASS