Home /

Expert Answers /

Finance /

5-constant-growth-rates-one-of-the-most-important-components-of-stock-valuation-is-a-firm-39-s-estim-pa238

(Solved): 5. Constant-growth rates One of the most important components of stock valuation is a firm's estima ...

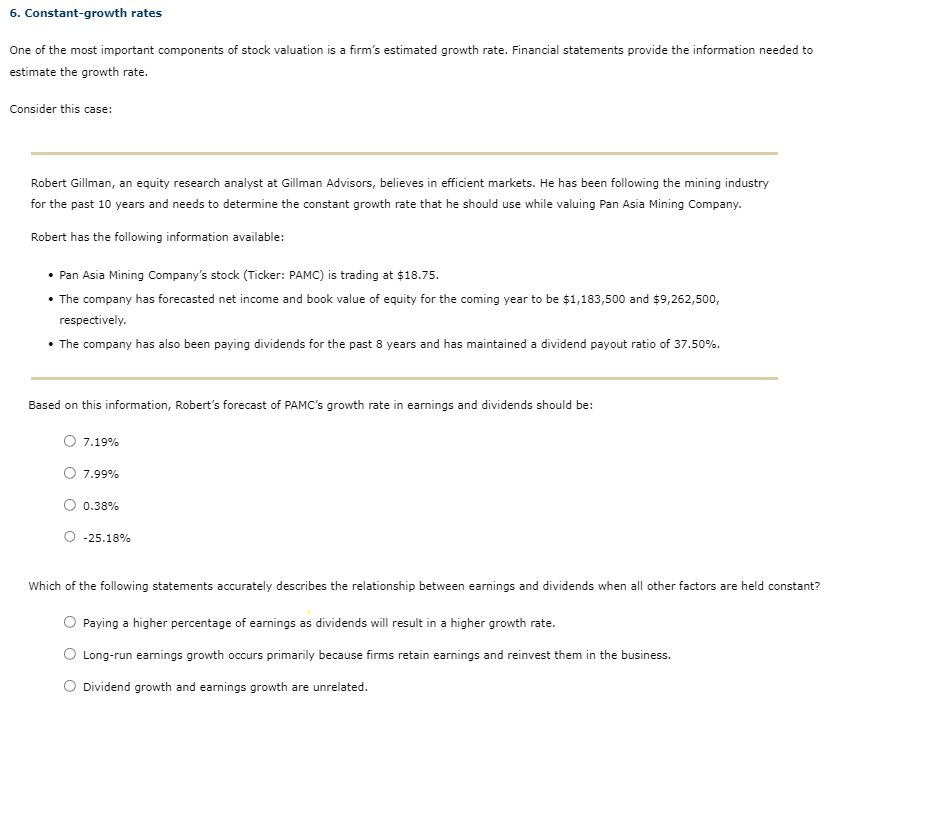

5. Constant-growth rates One of the most important components of stock valuation is a firm's estimated growth rate. Financial statements provide the information needed to estimate the growth rate. Consider this case: Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining industry for the past 10 years and needs to determine the constant growth rate that he should use while valuing Pan Asia Mining Company. Robert has the following information available: - Pan Asia Mining Company's stock (Ticker: PAMC) is trading at . - The company has forecasted net income and book value of equity for the coming year to be and , respectively. - The company has also been paying dividends for the past 8 years and has maintained a dividend payout ratio of . Based on this information, Robert's forecast of PAMC's growth rate in earnings and dividends should be: Which of the following statements accurately describes the relationship between earnings and dividends when all other factors are held constant? Paying a higher percentage of earnings as dividends will result in a higher growth rate. Long-run earnings growth occurs primarily because firms retain earnings and reinvest them in the business. Dividend growth and earnings growth are unrelated.