Home /

Expert Answers /

Economics /

5-calculating-tax-incidence-suppose-that-the-local-government-of-columbus-decides-to-institute-a-t-pa952

(Solved): 5. Calculating tax incidence Suppose that the local government of Columbus decides to institute a t ...

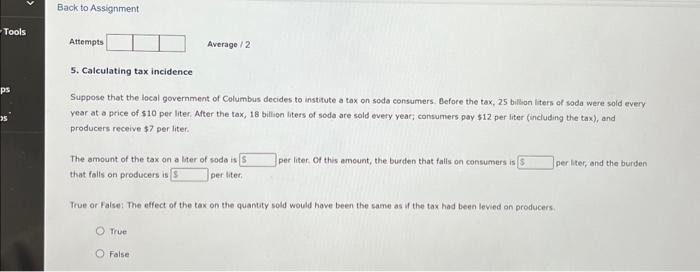

5. Calculating tax incidence Suppose that the local government of Columbus decides to institute a tax on sodo consumers. Defore the tax, 25 billion itters of soda were sold every year at a price of per liter. After the tax, 18 billion liters of soda are sold every year; consumers pay per liter (including the tax), and producers receive per liter. The amount of the tax on a liter of soda is that falls on producers is per liter, per liter. Of this amount, the burden that falls on consumers is per liter, and the burden True or False: The effect of the tax on the quantity sold would hove been the same as if the tax had been levied on producers True False