Home /

Expert Answers /

Economics /

4-computing-and-interpreting-average-tax-rates-in-a-hypothetical-economy-van-earns-34-000-pa660

(Solved): 4. Computing and interpreting average tax rates In a hypothetical economy, Van earns \( \$ 34,000 ...

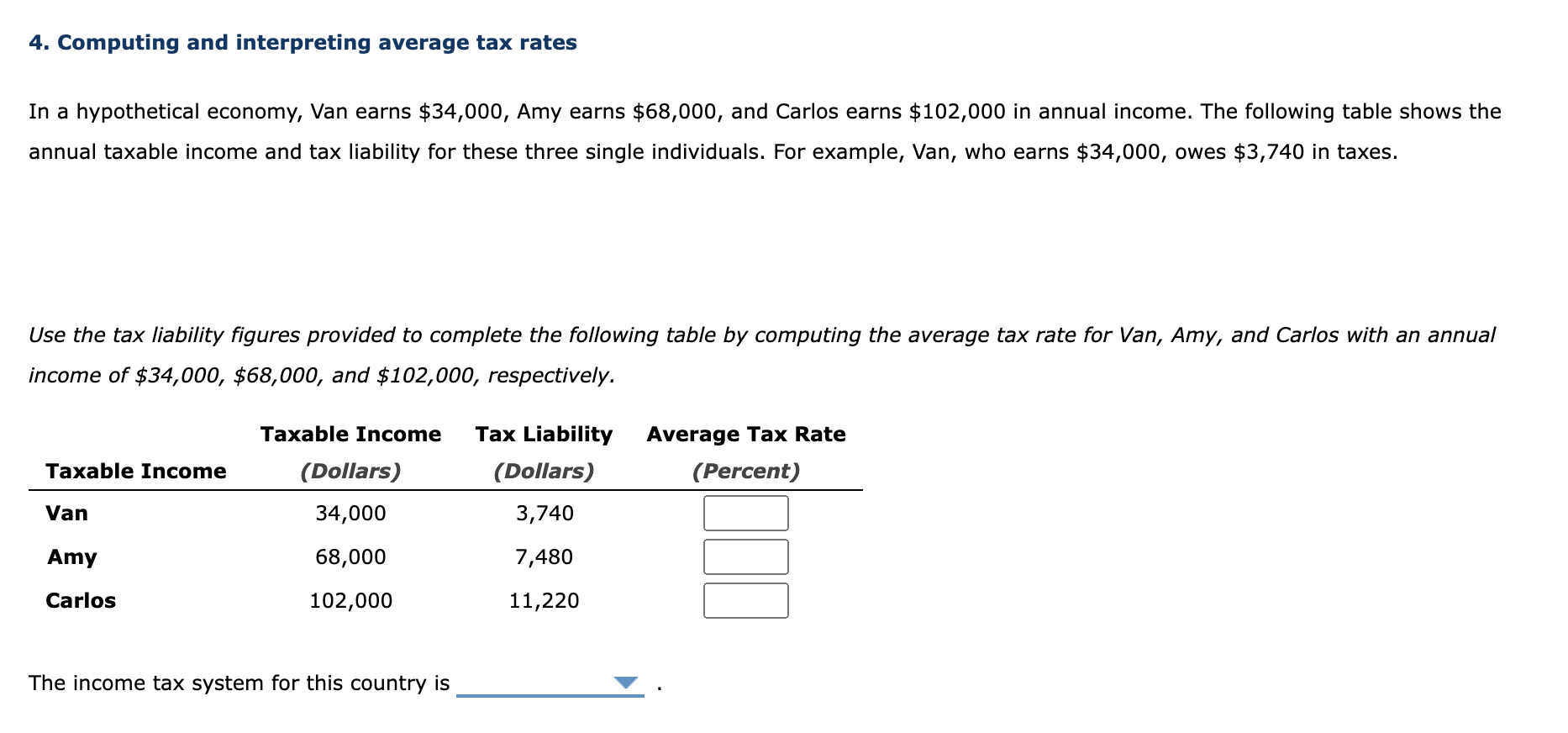

4. Computing and interpreting average tax rates In a hypothetical economy, Van earns \( \$ 34,000 \), Amy earns \( \$ 68,000 \), and Carlos earns \( \$ 102,000 \) in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Van, who earns \( \$ 34,000 \), owes \( \$ 3,740 \) in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Van, Amy, and Carlos with an annual income of \( \$ 34,000, \$ 68,000 \), and \( \$ 102,000 \), respectively. The income tax system for this country is

Expert Answer

Answer : Average tax = (Tax liability / taxable income) × 100 V