Home /

Expert Answers /

Finance /

30-pts-five-projects-are-available-for-investment-the-projects-require-the-cash-flows-and-yield-pa871

(Solved): [30 pts.] Five projects are available for investment. The projects require the cash flows and yield ...

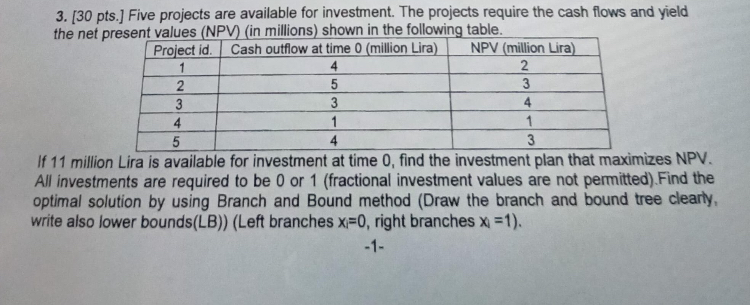

[30 pts.] Five projects are available for investment. The projects require the cash flows and yield the net present values (NPV) (in millions) shown in the following table. \table[[Project id.,Cash outflow at time 0 (million Lira),NPV (million Lira)],[1,4,2],[2,5,3],[3,3,4],[4,1,1],[5,4,3]] If 11 million Lira is available for investment at time 0 , find the investment plan that maximizes NPV. All investments are required to be 0 or 1 (fractional investment values are not permitted). Find the optimal solution by using Branch and Bound method (Draw the branch and bound tree clearly, write also lower bounds(LB)) (Left branches

x_(1)=0, right branches

x_(1)=1).

-1-