Home /

Expert Answers /

Accounting /

2023-tax-rate-schedules-individuals-schedule-v-1-married-filino-tointlv-nr-6-hank-signed-a-pa746

(Solved): 2023 Tax Rate Schedules Individuals Schedule V-1_Married Filino Tointlv nr 6. Hank signed a ...

2023 Tax Rate Schedules Individuals Schedule V-1_Married Filino Tointlv nr

6. Hank signed a contract hiring WEGO Catering to help cater breakfasts. At year-end, WEGO asked Hank to hold the last catering payment for the year, , untl after January 1 (apparently because WEGO didn't want to report the income on its tax return). The last check was delivered to WEGO in January after the end of the first year. However, because the payment related to the first year of operations. Hank included the in last year's catering expense. 7. Hank belleves that the key to the success of HW has been hiring Jimbo Jones to supervise the donut production and manage the shop. Because Jimbo is such an important employee. HW purchased a "key-employee" term-life insurance policy on his life. HW pald a premlum for this policy, and J will pay HW a death benefit if Jimbo passes away any time during the next 12 months. The term of the policy began on September 1 of last year, and this payment was included in "other business" expenditures. 8. In the first year. HW catered a large breakdast event to celebrate the city's anniversary. The city agreed to pay for the event. but Hank forgot to notify the city of the outstanding bill until January of this year. When he mailed the bill in January. Hank decided to discount the charge to . On the bill, Hank thanked the mayor and the city council for their patronage and asked them to "send a intle more business our way." This bill is not reflected in Hank's estimate of HW's income for the first year of operations. Required: a-1 and a-2. Hank files his personal tax return on a calendar year, but, he has not yet filed last years personai tax return, nor has he filed a tax return reporting HW's results for the first year of operations. Identify when Hank should file the tax return for HW and calculate the amount of taxable income generated using the cash method by HW last year. b. Determine the taxable income that HW Will generate if Hank chooses to account for the business uncier the accrual method. Note: Do not round intermediate calculations.

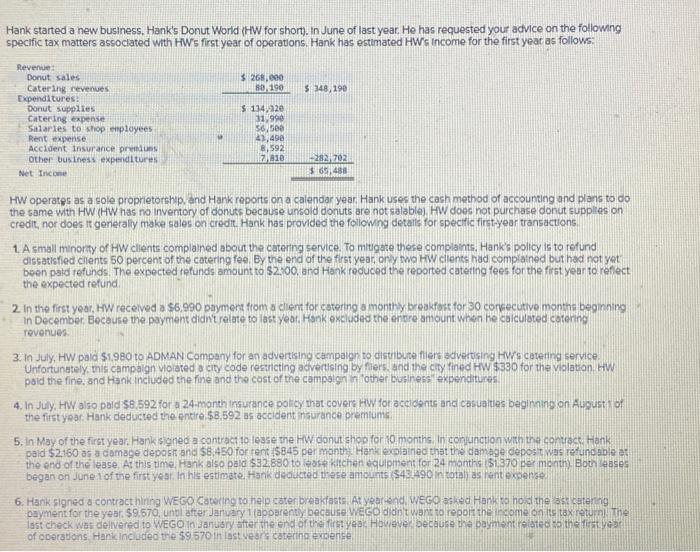

Hank started a hew business, Hank's Donut World (HW for short). In June of last year. He has requested your advice on the followng specific tax matters assoclated with HW's first year of operations. Hank has estimated HW's income for the first year as follows: HW operates as a sole proprietorship, and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to do the same with HW (HW has no inventory of donuts because unsold donuts are not salable), HW does not purchase donut supplies on credit, nor does tt generaly make sales on credit. Hank has provided the following details for spectic firstyear transactions. 1. A small minorty of HW clients complained about the catering service. To mitigate these complaints. Hank's policy is to refund dissatisfied clents 50 percent of the catering fee. By the end of the first year, on two HW clients had complained but had not yet been pald refunds. The expected refunds amount to , and Hank reduced the reported catering fees for the fist year to reflect the expected refund. in December. Because the payment didn' relate to last year. Hank excluded the encre amount when he calculated cotering revenues 3. In July, HW paid to ADMAN Compeny for an advertiking campalgn to distroute filer advertising HW/s cateting service. Unfortunately, this campalgn violated a city code restricting acvertising by fiers, and the cty fined HW for the violatoon. HW puld the fine, and Hank included the fine and the cost of the campalgn in iother businessi excenditures 4. In July, HW also pald for a 24 monthingurance polcy that coverc HW for accidents and casuates beginng on August I of the first ypar: Hank deducted the entire as accident insurance premums. 5. In May of the first year, Hank signed a contract 1o lesse she HW conut shop for 10 months. In conjunction with the contract. Hank pald as a damsge depost and for rert per monthy Hank polained that the damage depos was retundable a: the end of the lease. At this time, Hank also pald to lease kitchen equiment for 24 monthsi per month Both leases began on June tof the first yesi, In his estimate. Hank decucted these amounts S43.490 in rotali as rent exoense of poerations. Hankincluded the in last west caterno expense:

Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline & of taxable income \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & - & plus of the excess over \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline & & of taxable income \\ \hline & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the excess over \\ \hline & & plus of the exces over \\ \hline & - & plus of the exces over \\ \hline \end{tabular}