Home /

Expert Answers /

Accounting /

14-32-cost-plus-and-market-based-pricing-cma-adapted-accurate-laboratories-evaluates-the-react-pa536

(Solved): 14-32 Cost-plus and market-based pricing. (CMA, adapted) Accurate Laboratories evaluates the react ...

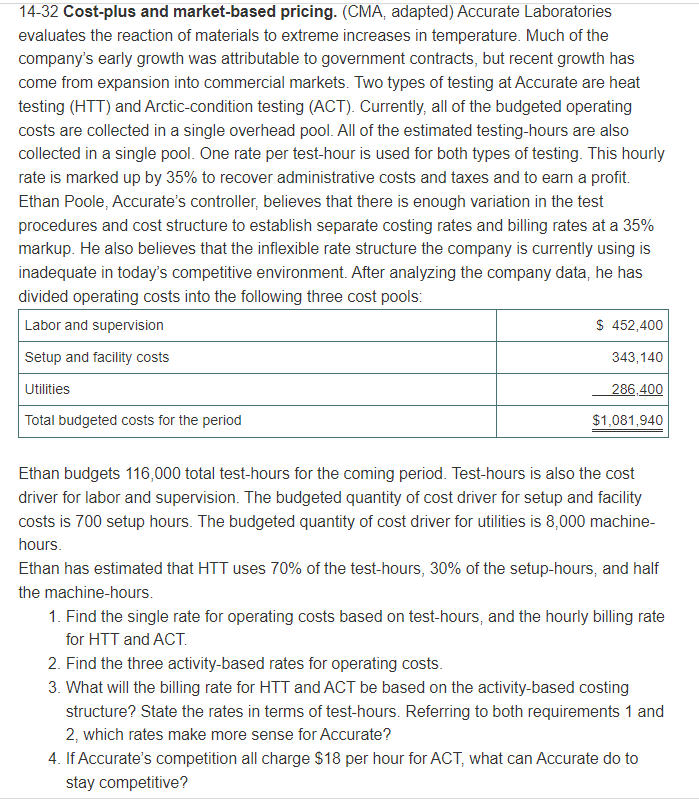

14-32 Cost-plus and market-based pricing. (CMA, adapted) Accurate Laboratories evaluates the reaction of materials to extreme increases in temperature. Much of the company's early growth was attributable to government contracts, but recent growth has come from expansion into commercial markets. Two types of testing at Accurate are heat testing (HTT) and Arctic-condition testing (ACT). Currently, all of the budgeted operating costs are collected in a single overhead pool. All of the estimated testing-hours are also collected in a single pool. One rate per test-hour is used for both types of testing. This hourly rate is marked up by \( 35 \% \) to recover administrative costs and taxes and to earn a profit. Ethan Poole, Accurate's controller, believes that there is enough variation in the test procedures and cost structure to establish separate costing rates and billing rates at a \( 35 \% \) markup. He also believes that the inflexible rate structure the company is currently using is inadequate in today's competitive environment. After analyzing the company data, he has divided operating costs into the following three cost pools: Ethan budgets 116,000 total test-hours for the coming period. Test-hours is also the cost driver for labor and supervision. The budgeted quantity of cost driver for setup and facility costs is 700 setup hours. The budgeted quantity of cost driver for utilities is 8,000 machinehours. Ethan has estimated that HTT uses \( 70 \% \) of the test-hours, \( 30 \% \) of the setup-hours, and half the machine-hours. 1. Find the single rate for operating costs based on test-hours, and the hourly billing rate for HTT and ACT. 2. Find the three activity-based rates for operating costs. 3. What will the billing rate for \( \mathrm{HTT} \) and ACT be based on the activity-based costing structure? State the rates in terms of test-hours. Referring to both requirements 1 and 2, which rates make more sense for Accurate? 4. If Accurate's competition all charge \( \$ 18 \) per hour for \( A C T \), what can Accurate do to stay competitive?

Expert Answer

a) Single rate = $1,081,940 / 116,000 = $9.33 per uni