Home /

Expert Answers /

Operations Management /

13-supply-chain-design-muslin-office-furniture-manufactures-a-popular-line-of-filing-cabinets-and-pa290

(Solved): 13. Supply Chain Design Muslin Office Furniture manufactures a popular line of filing cabinets and ...

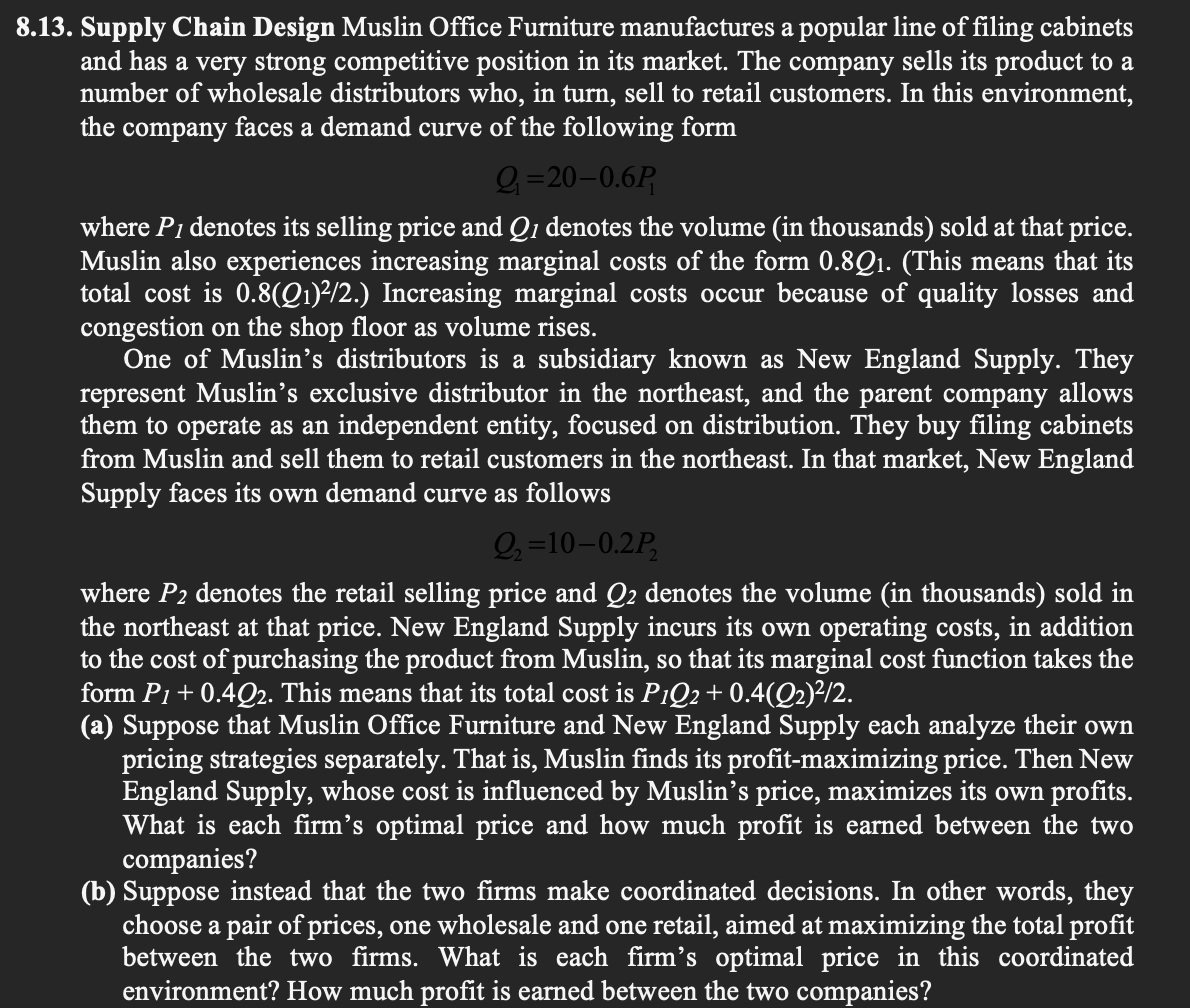

13. Supply Chain Design Muslin Office Furniture manufactures a popular line of filing cabinets and has a very strong competitive position in its market. The company sells its product to a number of wholesale distributors who, in turn, sell to retail customers. In this environment, the company faces a demand curve of the following form where denotes its selling price and denotes the volume (in thousands) sold at that price. Muslin also experiences increasing marginal costs of the form . (This means that its total cost is .) Increasing marginal costs occur because of quality losses and congestion on the shop floor as volume rises. One of Muslin's distributors is a subsidiary known as New England Supply. They represent Muslin's exclusive distributor in the northeast, and the parent company allows them to operate as an independent entity, focused on distribution. They buy filing cabinets from Muslin and sell them to retail customers in the northeast. In that market, New England Supply faces its own demand curve as follows where denotes the retail selling price and denotes the volume (in thousands) sold in the northeast at that price. New England Supply incurs its own operating costs, in addition to the cost of purchasing the product from Muslin, so that its marginal cost function takes the form . This means that its total cost is . (a) Suppose that Muslin Office Furniture and New England Supply each analyze their own pricing strategies separately. That is, Muslin finds its profit-maximizing price. Then New England Supply, whose cost is influenced by Muslin's price, maximizes its own profits. What is each firm's optimal price and how much profit is earned between the two companies? (b) Suppose instead that the two firms make coordinated decisions. In other words, they choose a pair of prices, one wholesale and one retail, aimed at maximizing the total profit between the two firms. What is each firm's optimal price in this coordinated environment? How much nrofit is earned between the two comnanies?

Expert Answer

according to the data.............I HAVE DONE WITH SOME PARTS FROM THE ABOVE PROBLEM