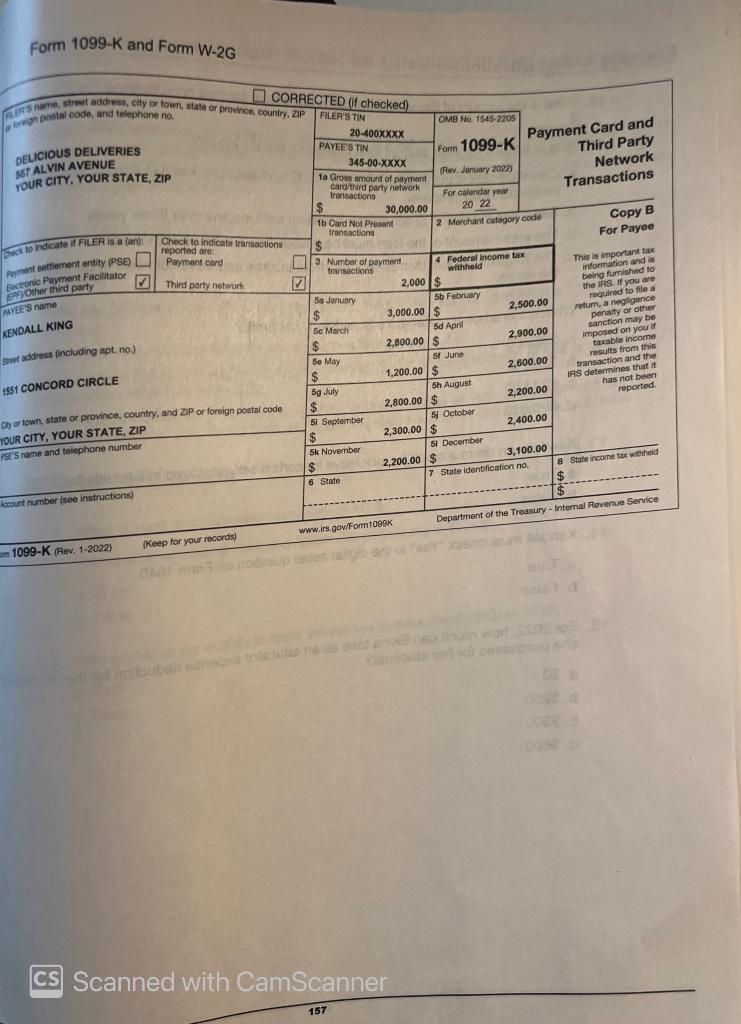

Form 1099-K and Form W-2G

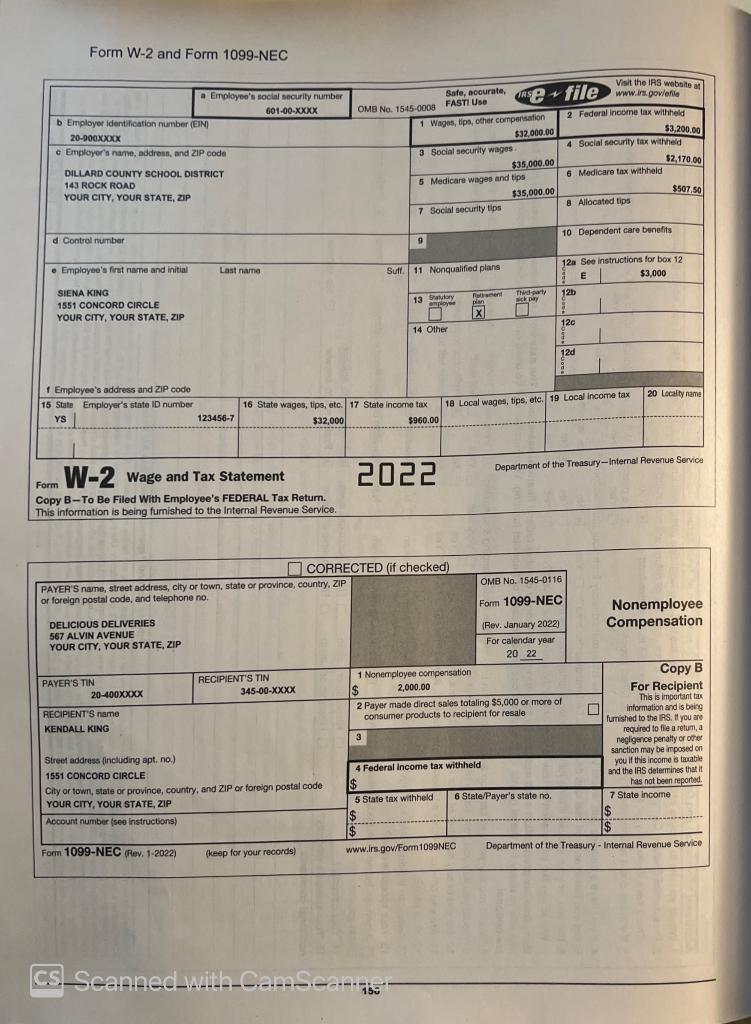

Form W-2 and Form 1099-NEC

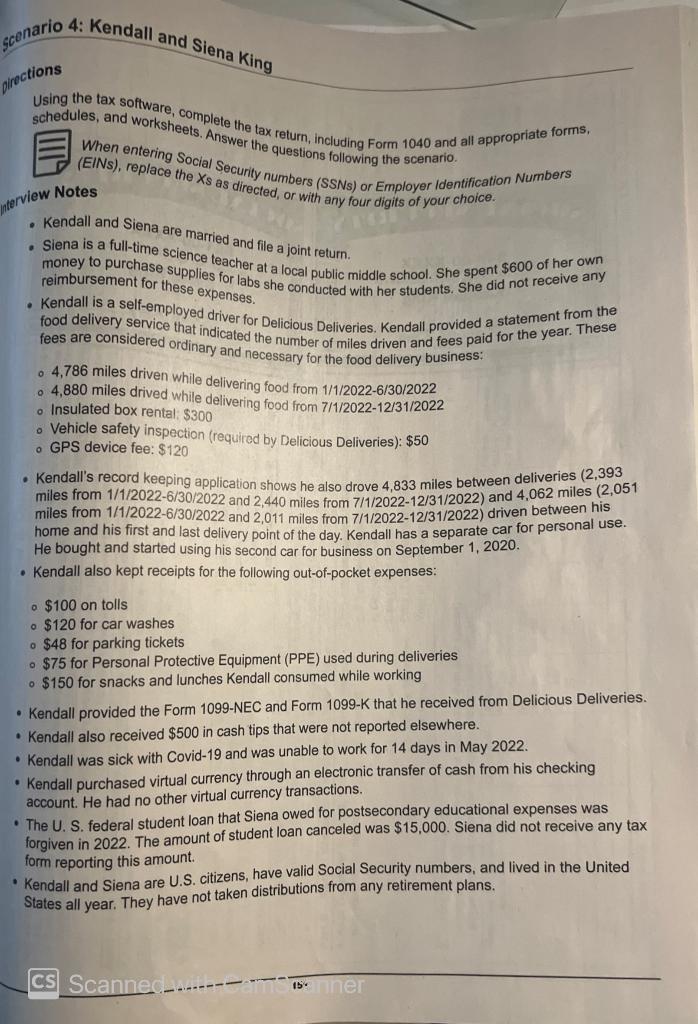

irections Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, and worksheets. Answer the questons following the scenario. When entering Social Sther questions following the scenario. (ElNs), replace the \( x \) Security numbers (SSNs) or Employer Identification Numbers terview Notes - Kendall and Siena are married and file a joint return. - Siena is a full-time science teacher at a local public middle school. She spent \( \$ 600 \) of her own money to purchase supplies for labs she conducted with her students. She did not receive any reimbursement for these expenses. - 4,880 miles drived while delivering food from \( 7 / 1 / 2022-12 / 31 / 2022 \) - Insulated box rental: \( \$ 300 \) - Vehicle safety inspection (required by Delicious Deliveries): \( \$ 50 \) - GPS device fee: \( \$ 120 \) - Kendall's record keeping application shows he also drove 4,833 miles between deliveries (2,393 miles from \( 1 / 1 / 2022-6 / 30 / 2022 \) and 2,440 miles from \( 7 / 1 / 2022-12 / 31 / 2022) \) and 4,062 miles (2,051 miles from \( 1 / 1 / 2022-6 / 30 / 2022 \) and 2,011 miles from \( 7 / 1 / 2022-12 / 31 / 2022 \) ) driven between his home and his first and last delivery point of the day. Kendall has a separate car for personal use. He bought and started using his second car for business on September 1, 2020. - Kendall also kept receipts for the following out-of-pocket expenses: - \$100 on tolls - \$120 for car washes - \( \$ 48 \) for parking tickets - \$75 for Personal Protective Equipment (PPE) used during deliveries - \$150 for snacks and lunches Kendall consumed while working - Kendall provided the Form 1099-NEC and Form 1099-K that he received from Delicious Deliveries. - Kendall also received \( \$ 500 \) in cash tips that were not reported elsewhere. - Kendall was sick with Covid-19 and was unable to work for 14 days in May 2022. - Kendall purchased virtual currency through an electronic transfer of cash from his checking account. He had no other virtual currency transactions. - The U.S. federal student loan that Siena owed for postsecondary educational expenses was forgiven in 2022 . The amount of student loan canceled was \( \$ 15,000 \). Siena did not receive any tax form reporting this amount. - Kendall and Siena are U.S. citizens, have valid Social Security numbers, and lived in the United States all year. They have not taken distributions from any retirement plans.