Home /

Expert Answers /

Economics /

1-understanding-the-implications-of-taxes-on-welfare-the-following-graph-represents-the-demand-and-pa952

(Solved): 1. Understanding the implications of taxes on welfare The following graph represents the demand and ...

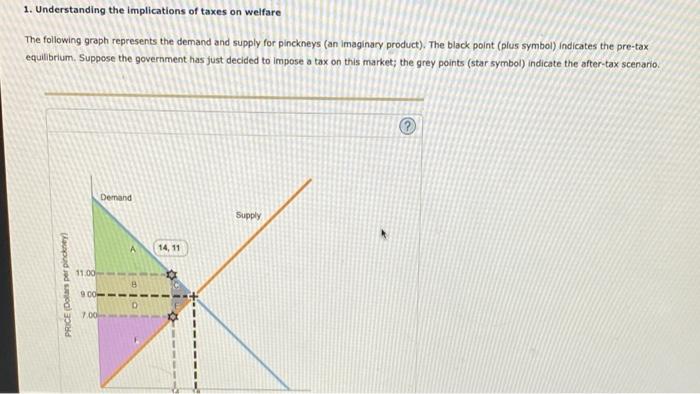

1. Understanding the implications of taxes on welfare The following graph represents the demand and supply for pinckneys (an imaginary product). The black point (plus symbol) indicates the pre-tax equilibrium. Suppose the government has just decided to impose a tax on this market; the grey points (star symbol) indicate the after-tax scenari PRICE (Dollars per pinckney 11.00 Demand 9.00- 7.00 8 D 14, 11 Supply

GAGE | MINDTAP ork (Ch 08) PRICE (Dollars per pinckney) 11.00 9.00 7.00 20 3 # Demand F3 O P 54 THRESHEHE KE se Please follow these instructions to complete the Bloomberg Certificate 30 $ 4 18,9 1 DOD GOD 14 QUANTITY Poneys) Supply % 5 MacBook Air & 6¬ a lo 147108ISBN 44 1 7 17 2

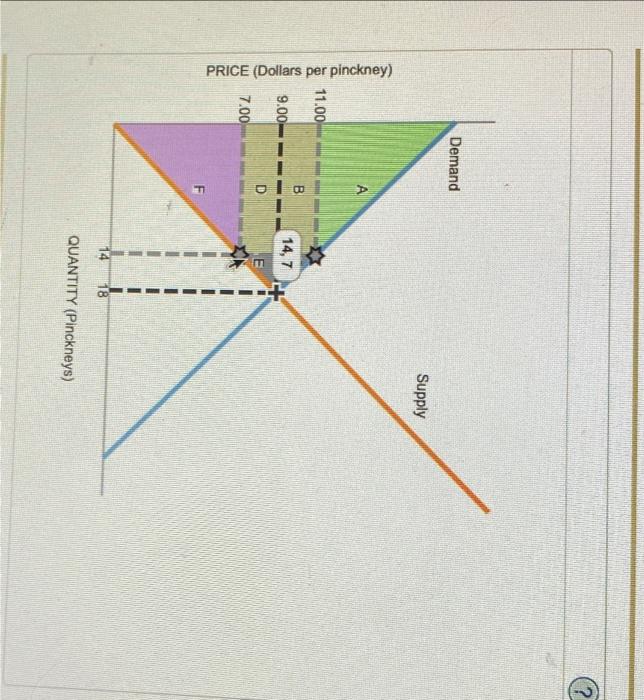

PRICE (Dollars per pinckney) 11.00 9.00- 7.00 Demand w A BIO ? F 14,7 E 18 Supply QUANTITY (Pinckneys) ?

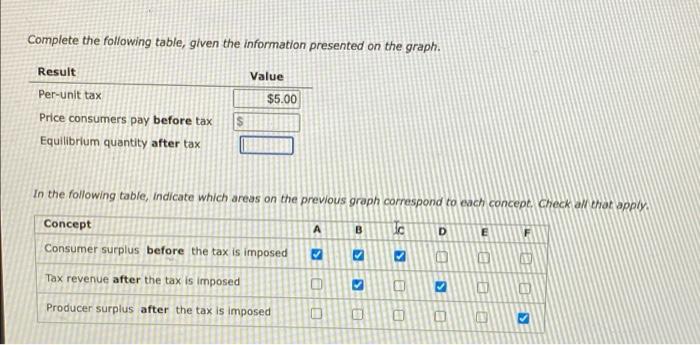

Complete the following table, given the information presented on the graph. Value $5.00 Result Per-unit tax Price consumers pay before tax Equilibrium quantity after tax In the following table, indicate which areas on the previous graph correspond to each concept. Check all that apply. Concept Consumer surplus before the tax is imposed Tax revenue after the tax is imposed Producer surplus after the tax is imposed A S A CO B ? ? 10 ic ? 81 19 ? E 19 11 IN F 19

Expert Answer

Per unit tax = difference between price paid by buyers and price received by seller