Home /

Expert Answers /

Accounting /

1-there-are-three-securities-in-the-market-the-following-chart-shows-their-possible-payoffs-2-pa658

(Solved): 1. There are three securities in the market. The following chart shows their possible payoffs: 2. ...

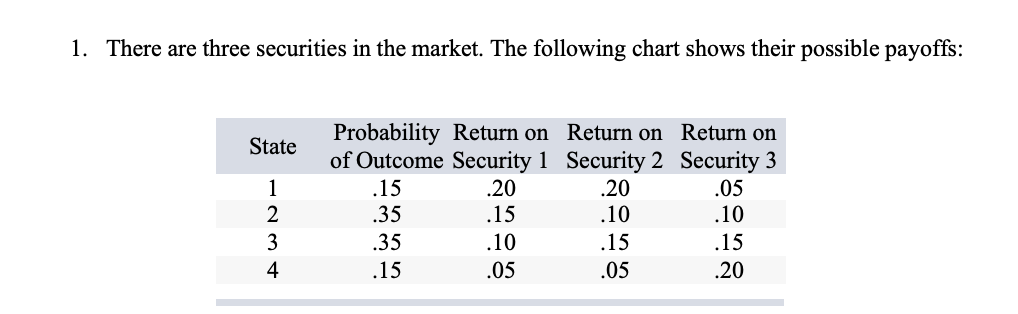

1. There are three securities in the market. The following chart shows their possible payoffs:

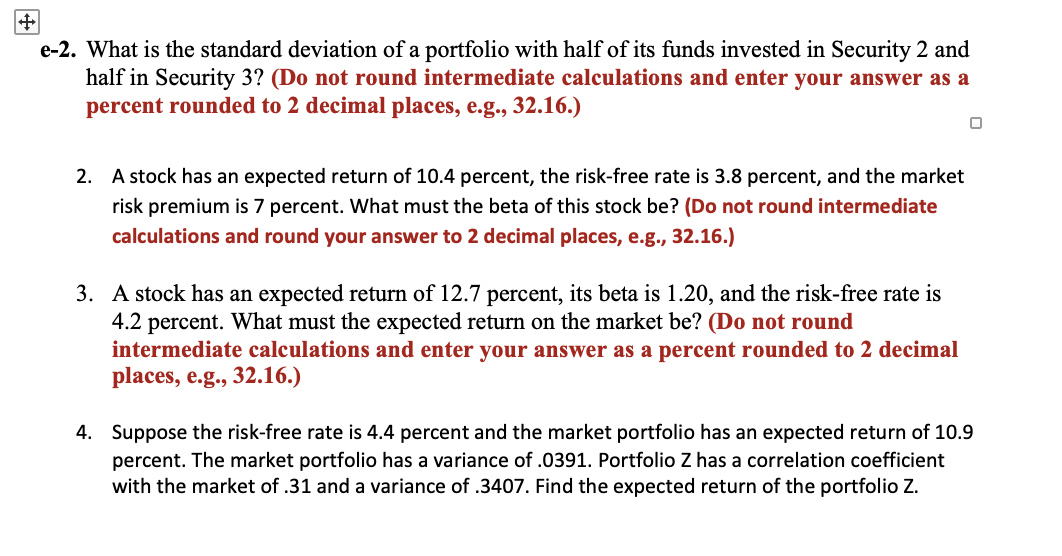

2. What is the standard deviation of a portfolio with half of its funds invested in Security 2 and half in Security 3? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 2. A stock has an expected return of \( 10.4 \) percent, the risk-free rate is \( 3.8 \) percent, and the market risk premium is 7 percent. What must the beta of this stock be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 3. A stock has an expected return of \( 12.7 \) percent, its beta is \( 1.20 \), and the risk-free rate is \( 4.2 \) percent. What must the expected return on the market be? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 4. Suppose the risk-free rate is \( 4.4 \) percent and the market portfolio has an expected return of \( 10.9 \) percent. The market portfolio has a variance of .0391. Portfolio \( \mathrm{Z} \) has a correlation coefficient with the market of \( .31 \) and a variance of \( .3407 \). Find the expected return of the portfolio \( Z \).